An evolving program

The Viva Seguro program has evolved based on impact assessments and diagnoses that have provided knowledge for developing new strategies focused on behavioral change and population segmentation. The program and the design of its tools are constantly assessed, and public-private interactions are promoted.

Effective methods for bringing information and promoting knowledge

The program was created in 2008 and has always had conceptual and assessment support which has allowed innovation and the evolution of strategies.

2008:

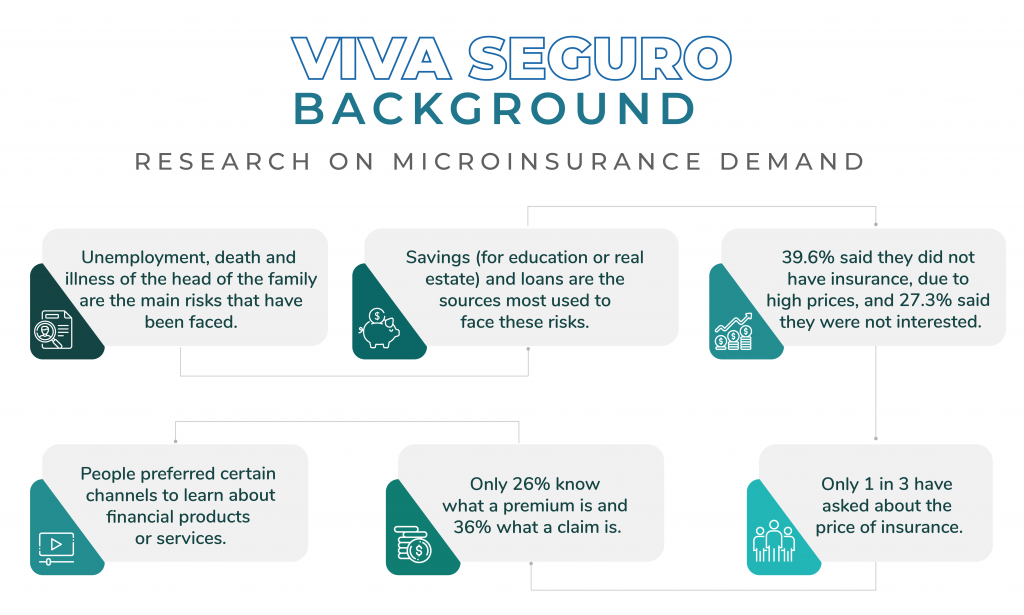

Fasecolda hired YanHaas[1] to carry out the first survey on microinsurance demand, which showed the following results:

Viva Seguro: background

Survey on microinsurance demand

Unemployment, death, and illness of the head of the family are the main risks that have been faced.

39.6% said they did not have insurance, due to high prices, and 27.3% said they were not interested in it.

Additionally, respondents reported that they prefer to get information and training on financial education information through workshops (39%), television (34%), booklets (21%), videos (20%), internet (16%) and radio (9 %).

Based on the survey results, Fasecolda launched the financial education program Viva Seguro, which included radio programs and educational material, such as guides and face-to-face workshops, developed with the methodology designed by the NGO Microfinance Opportunities.

The following are the workshops and radio programs achievements:

- Training more than 27,000 people through workshops; about three thousand per year.

- The broadcasting of a 36 chapters radio program, 40 minutes each, in four cities, which reached 290,000 listeners. The audios are available on the Viva Seguro program website.

- The broadcasting of 33 radio capsules, three minutes each, on 20 popular radio stations in six cities of the country; about 1.5 million listeners.

- The publication of 24 short messages in two free newspapers, in four of the main Colombian cities; about two million readers.

- The broadcasting of 33 television news bulletins on crop and livestock insurance, on Caracol Televisión’s program La Finca de Hoy (Today’s Farm), watched by about 400,000 people.

Studies have shown that targeted strategies can change habits and behaviors.

Impact assessment and diagnosis of habits and behaviors related to risk and insurance

Why is it important to assess the financial education programs?

Assessing the results of financial education programs makes it possible to establish the actual needs of the population and the most effective way to reach them to promote their financial well-being. According to the OECD, it is also necessary to measure the population’s financial education levels in order to identify gaps and design proper responses.

Impact assessment of the Viva Seguro program

In 2012, Viva Seguro hired Universidad de Los Andes to carry out an impact assessment research [1] on the face-to-face workshops and the radio program; this was conducted over three years on a population of 560 workshop students and 956 listeners of the radio program.

It was evident that both the radio program listeners and the workshops students improved their knowledge on the risks which they were or could be exposed to, and the types of insurance available in the country, but few of them had taken action to save money or buy insurance.

Diagnosis of habits and behaviors regarding risks and insurance in the Viva Seguro program.

Subsequently, Viva Seguro hired Corpovisionarios [2] to carry out a diagnosis of habits and behaviors related to risks and insurance, in order to identify strategies to achieve behavioral changes regarding financial issues by using recreational and learning actions and to know the population’s motivations and needs.

The diagnosis results showed the following:

- There is a high perception of risk, i.e., people are aware that they are exposed to various events that can destabilize their situation, but they do not decide to buy insurance.

- There is a positive relationship between those who think that good things will happen to them and their willingness to buy insurance.

- 82% of respondents think that insurance is a good tool for dealing with risks.

- It was found a positive relationship between those who have insurance and conclude the projects they undertake; besides it, those who do not have insurance expressed a high willingness to buy it.

Redesigning the Financial Education Strategy

Based on the results of the abovementioned studies, Viva Seguro was strengthened with tools focused on building a pedagogical process under the citizen culture approach, aiming to achieve changes in habits and behaviors and that insurance buying is done consciously and responsibly.

Additionally, it was considered the Organization for Economic Cooperation and Development (OECD) recommendation that promotes the development of financial education strategies according to the type of population.

[1] File: Executive summary. Impact assessment of the Viva Seguro radio program and workshops (2014).

[2] File: Summary. Diagnosis Report.

Financial education and behavioral change, the cornerstones of sustainable development.

Viva Seguro into the future

What are the financial education basics for the future?

Continuous learning is the driving force of the Viva Seguro financial education program and promoting sustainable development through specific actions that generate resilience in homes is the program’s approach to the population.

To achieve these goals, Viva Seguro works under the following premises:

Resilience and risk management

It focuses on defining and managing risks, based on family goals forecasting, to promote consumer confidence and build resilience.

Transversality

Viva Seguro is aimed at the entire Colombian population and will promote a sense of belonging and the standardization of good practices throughout the financial system.

Behavioral change

“The application of behavioural science in financial education programmes is relatively new, but offers promising insights to design initiatives that take into account the decision-making process of individuals and the biases that are likely to influence their financial decisions”. [1] In this sense, the strategies to be developed and promoted for the future will have the following characteristics:

- The content should be targeted, timely, and easy to understand.

Being focused, it covers only one topic at a time, which should be simple, concrete, and relevant. The information provided must be timely, i.e., it must be synchronized with the time of decision-making [2] and it must be easy to understand.

- Education as personalized as possible.

In this regard, the age, abilities, and personality traits of people, [3] as well as their specific needs and financial situations, will be considered.

- Proper and entertaining designs.

New and innovative initiatives usually generate greater recall in the audience; digital channels will be used to include attractive and entertaining content.

- Community involvement

“People have a better understanding of insurance companies based on the experiences of their acquaintances”,[4] therefore, the strategies to be developed will seek to generate shared perceptions in communities.

Constant monitoring and assessment: the Viva Seguro program will continue monitoring and assessing its impact to periodically evaluate the progress of this financial education program, in order to make the necessary adjustments so that its benefits are available for more Colombians.

[1] OECD. (2019). Smarter financial education: key lessons froms behavioural insights for financial literacy initiatives.

[2] Rouse, R. (2017). Más allá del aula: Evidencia de nuevos rumbos en educación financiera. Innovations for Poverty Action.

[3] Roa, M., Garrón, I., & Barboza, J. (2017). La importancia de las habilidades numéricas, rasgos de personalidad y la alfabetización financiera en la toma de decisiones financieras: Un análisis empírico en la región Andina: Bolivia, Colombia, Ecuador, Perú. División de Estudios Económicos, CEMLA.

[4] Archivo: Informe resumido Diagnostico

[1] Archivo: Resumen Resultados demanda de microseguros 2009. Fundaseg, Fasecolda, YanHaas