Transition risks

Transition risks are all those arising from the progressive change from the current economic model to one based on activities with low greenhouse gas (GHG) emissions; it is made up of four types of risks related to changes in policies, technologies, market prices, and business reputation, which materialize in the shift to a low-carbon economy (TCFD, 2017).

- Legal risks: arise as a result of the creation or modification of public policies aimed at limiting those actions that worse the adverse effects of climate change.

- Technological risks: are those related to the replacement of technologies that generate high GHG emissions by more efficient and less polluting technologies.

- Market risks: arise as a result of specific changes in supply and demand, driven by the need to include new production and consumption dynamics focused on GHG reduction.

- Reputational risk: is the risk of a change in the perception of a company’s image by customers, shareholders, suppliers, regulators, or the community, due to its major or minor contribution to the transition to a low-carbon economy.

How are we managing these risks?

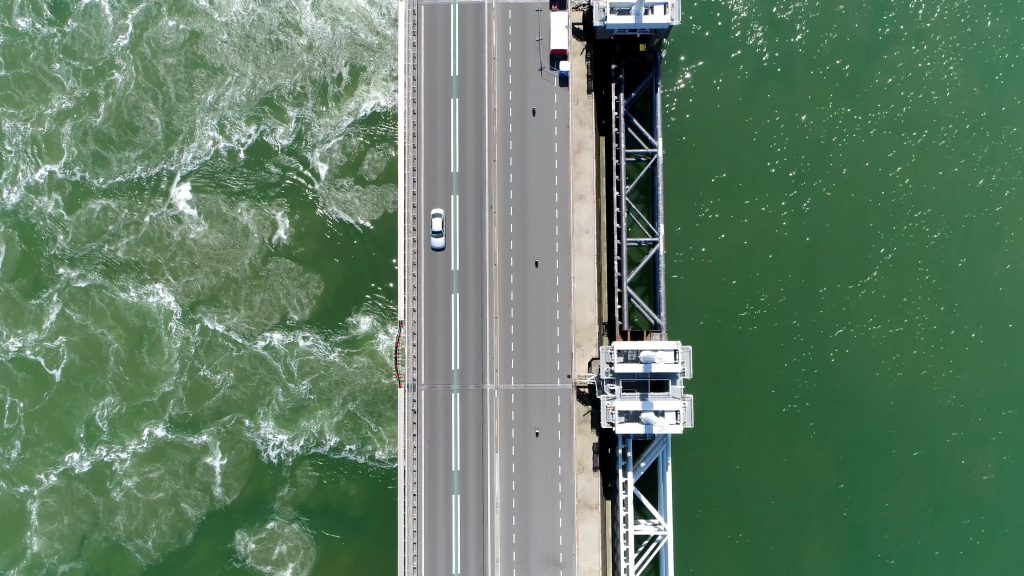

Transition risks are likely to be severe in markets that need further decarbonization, and for financial institutions that have invested in companies in these sectors. Therefore, Colombian insurance companies are assessing the industries that would be most affected by this change, in order to reduce the risk and the economic losses derived from transition risks.

An example of transition risks in Colombia is the tax reform stated in Act 1819-2016, which created a carbon tax, $16,827 (about EUR 4.7) for each ton of carbon dioxide (CO2) emitted into the atmosphere. This tax generates higher operational costs for companies that pollute, which decreases their profits and negatively impacts their stock exchange valuation.

Measuring the exposure of investment portfolios to transition risks

For the insurance industry, it is important to identify transition risks before they materialize, to prevent additional costs. Fasecolda partnered with 2 Degrees Investing Initiative (2DII) to conduct climate scenario analysis on the insurers’ investment portfolio, both at the individual insurer level and at the aggregate market level, to identify the possible transition risks to which they may be exposed.

- The executive summary, published in Fasecolda Magazine, is available here or at the end of this section.

This analysis was intended to help understand the exposure of Colombian insurance companies to financial risks related to the energy transition, assessing whether it would be planned or disruptive.

What are we going to do?

Climate change stress testing for investment portfolios

Stress tests are widely used by central banks and financial regulators to assess the resilience of the financial sector to sudden changes. However, the characteristics of climate change differ significantly from those considered in traditional stress testing exercises, as climate change is forward-looking and with uncertainty characteristics, which means a great challenge in terms of climate risk projections (PRI, 2020).

For the climate change stress tests, input data such as climate variables, macroeconomic variables, and financial variables are used to assess portfolios and companies. Subsequently, the impact is evaluated, based on the model map, portfolio priority, sectors, and geographies. The tests also assess the current vulnerability and sector and geographic vulnerabilities, in order to have a better measurement and risk management, and an understanding of the challenges that should be included in the business models (ManagementSolutions, 2020).

Measuring the impact of transition risks on insurance processes

The insurance industry has started measuring the impact of transition risks on insurance sales in order to mitigate the costs involved. The companies most vulnerable to transition risks are being evaluated and are being offered advice for the medium and long-term transition, to avoid and mitigate exposure to these risks.

Additional links

Executive Summary: The Exposure to Transition Risks in the Insurance Industry

Gauging the exposure to transition risks of Colombian insurers’ investment portfolios

Strengthening the insurance sector performance

Sustainability School

Fasecolda provides training on climate risk to strategic areas within the insurance companies; for this purpose, we have created a specialized course on climate risk management at the Sustainability School. This tool has made it possible to transfer best practices in sustainability to the insurance sector, in order to comply with our strategy of sustainable growth and strengthen the country’s resilience in case of future unfavorable eventualities must be faced.

We invite you to watch the following video in which we summarize our progress at the Fasecolda Sustainability School.